How Can You Avoid NDIS Fraud As A Participant Or Provider

May 16, 2025

|By Careassure

|7 min read

If this is your first time seeing NDIS fraud, the first question that will pop up is, what is fraud? Someone is committing NDIS fraud when they attempt to steal or abuse money intended for NDIS members. Even though it is the responsibility of a task force to investigate and prosecute these offences, it is possible that fraud won't be discovered until later. As a member of the NDIS program, there are measures you may take to protect yourself from fraud, even though doing so might seem difficult.

You can understand the factors that go into the pricing of services and supports offered by NDIS service providers by viewing the NDIS Price Guide. Adherence to these regulations guarantees that the participants will receive the necessary assistance at a reasonable cost. A credible NDIS service provider will only offer services compliant with the criteria established in the NDIS Price Guide. This ensures that participants receive the most cost-effective care possible.

Payment integrity And conflict of interest

It is important to maintain payment integrity by ensuring that you pay the appropriate amount for the appropriate service, pay on time for the services you receive, and retain records of all your financial transactions. Checking your invoices before paying them to ensure that what you were charged for was delivered illustrates this principle. Establishing what the NDIS refers to as a "Service Agreement" with every one of your support providers is an effective strategy for preserving payment integrity. This written contract, which both you and your service provider must sign, will ensure that the money in your plan is used to pay for the services you require at the price and frequency you agreed upon with the provider. On the NDIS website, you will find a sample of a Service Agreement that you can use.

A conflict of interest refers to a situation in which a person's interests in one topic are at odds with their obligations to another individual, organisation, or community regarding the same matter. This conflict can either be actual or appear to be real. One example would be failing to disclose to the NDIA and comprehend the process they use to provide their services. In addition, getting to know them will shed light on their principles and the values that guide their behaviour.

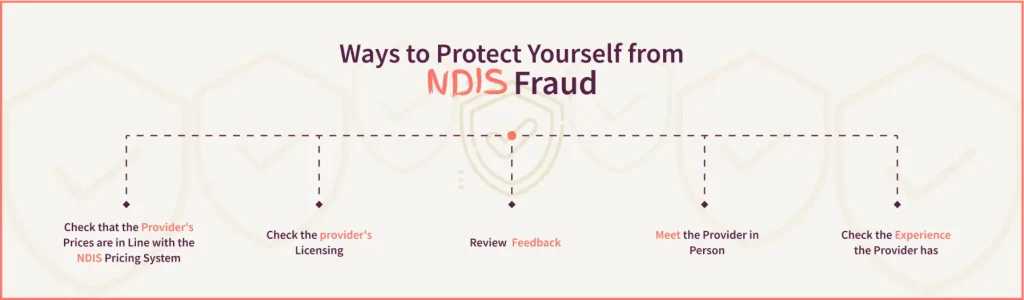

5 Ways to Protect Yourself from NDIS Fraud

As a participant in the NDIS, it might not be obvious how to safeguard yourself against fraud, but there are actions you can take to protect yourself from being taken advantage of. You may find the following suggestions helpful:

1. Check the provider's licensing

When reviewing the provider's license, you should look for evidence that they are insured, licensed, and bonded. A reliable supplier should hold all of the qualifications that grant them legitimacy and allow them to deliver NDIS services to earn customers' trust. In addition to this, check to see that they adhere to the NDIS code of conduct and the practice standards. Visit the NDIA website and search for them, or contact them directly to verify their qualifications.2. Read reviews

When selecting a company, looking at reviews and testimonials from previous customers is critical. Because of this, you can make an informed decision and avoid the issues other people have had with unreliable service providers. Before you pick up the phone, make it a habit to look over testimonials from reputable organisations.3. Check that the provider's prices align with the NDIS pricing system

Please take the time to read through the NDIS price guide to understand of how the price ranges for NDIS services and support work are managed. Because of the regulations, the program's participants are guaranteed to get the most out of the money they spend on the assistance they receive. A legitimate NDIS provider will only offer their services at acceptable rates according to the price guide established by the NDIS.4. Meet the provider in person

When it comes time to decide on your provider, you might want to consider paying a visit to their office. This will allow you to understand how they are in person, determine how well they get along with you, and comprehend the process they use to provide their services. In addition, getting to know them will shed light on their principles and the values that guide their behaviour.5. Check the experience level

Finding an experienced NDIS provider might assist you in avoiding being a victim of potential fraud; this may seem like a relatively unimportant factor to consider. Because the NDIA is such a vigilant and perceptive organisation, any provider engaging in fraudulent activity won't be able to maintain their status for long. NDIS providers who have worked with participants for an extended period are considered trustworthy, safe, and reliable. Experience also indicates that they are highly established, which ensures they will provide superior services.Conclusion

There are several measures that both NDIS participants and providers can take to avoid fraud. As an NDIS participant, choosing a reputable provider registered with the NDIS and with a good track record is essential. Additionally, you should keep detailed records of all services received and ensure that invoices match the services provided. For NDIS providers, it is crucial to maintain accurate and up-to-date records of all services provided and to ensure that invoices are accurate and transparent. It is also essential to have robust internal controls and training programs to detect and prevent fraud.

At Care Assure, we understand the importance of preventing NDIS fraud and are committed to upholding the highest standards of integrity and transparency. We have implemented strict internal controls and training programs to prevent fraud and protect the interests of our participants. By working with us, you can have peace of mind knowing that you are partnering with a company that takes NDIS fraud prevention seriously.

Frequently Asked Questions (FAQs)

Fraudsters usually use many different methods to get money from the NDIS programme. Most of the time, these strategies are used to take advantage of either NDIS providers or users. Here are some of the most common ways they take advantage of their victims:

• Making false claims: This method involves making false claims for some NDIS supports or services that show they were not done, given, or delivered as the provider said they would be.

• Working together with Providers: Fraudsters sometimes work behind the scenes with service providers or staff at these groups to make fake or exaggerated claims for services that weren't provided.

• Identity theft: Identity theft is when someone uses someone else's personal information and data without their permission to get NDIS funds and services.

• Overpricing: Some NDIS companies who aren't following the rules may charge more for certain services.

• Awful Use of NDIS Funds: Some users commit NDIS fraud by using the money for personal costs instead of following their plan and using the money as planned.